How do you increase your chances of making serious passive income from investing if you don’t have the expertise, time or capital base of a Warren Buffett?

Photo: Fortune

If you look at how much money Warren Buffett has made by simply sitting at his desk in lil ol’ Omaha, you’ll agree that investing can be THE easiest and smartest way to make passive income.

Think about it. You literally buy some assets and then you sit back and watch the income and capital gains stream in.

Month after month. Without any ongoing work on your part.

Unfortunately, when it comes to making money from investing most of my readers seem to tell me the same thing…

“Richard, I’m no Wendy’s-eating, cherry coke-sculling mini Warren Buffett! I don’t have the expertise, the time nor the capital to make serious money from investing.”

And worse yet, other readers share stories about investing their hard earned money, only to see it vanish in stock market crashes, bad real estate deals or some half-cooked investment scheme their fast talking Irish brother-in-law Mickey O’Toole dragged them into.

(Damn you Mickey!)

And hey, I get it. After all…

Most investments don’t really work out so great in reality

For example, investing in rental properties sounds good in theory.

However the skills you need in order to pick the right properties (right region, right location, right type) with the right financing deal (this is oh so important) and at the right time (so the numbers crunch perfectly and allow a margin of safety), is extremely difficult to master.

And even if you have the skill, boy do you need a good network of referrers (aka spotters), as well as agents and service people, to make it happen – and keep it at full occupancy.

Not to mention some serious capital to make the down payment and service any interest in the event of a negatively geared deal.

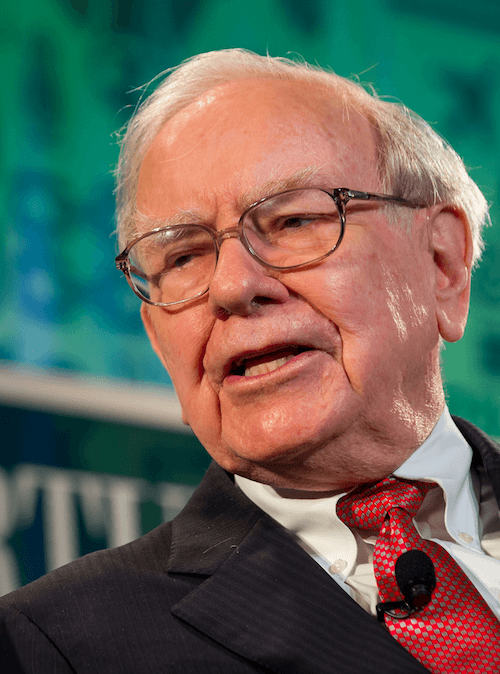

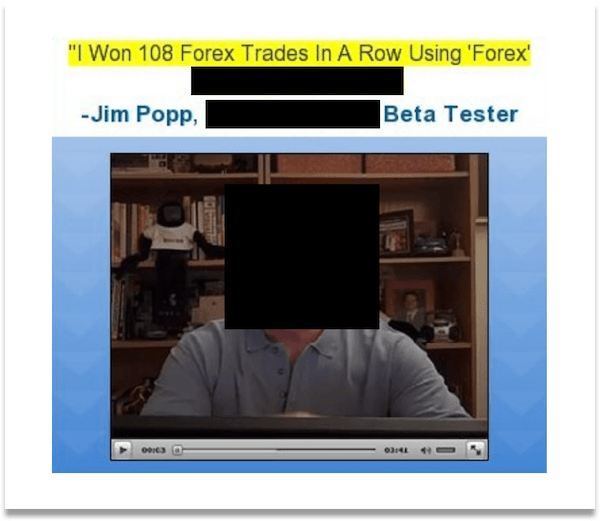

Another example, dividend stocks.

I personally love them and invest heavily in them, as they provide recurring cash flows, which when reinvested via an automated dividend reinvestment plan (DRIP), offer up some delicious compounding returns over time.

But unfortunately unless you have $100,000+ to invest, you are probably going to see very little in returns.

For example, a $10,000 investment across a portfolio of quality dividend stocks is likely going to yield you returns on average somewhere in the range of 2-4%.

That means after a whole year has passed, that $10,000 of your hard earned money will return you just $300 or so in cash dividends.

Or said differently, barely enough to buy a family pass to Disney Land!

Photo: we can see how little traditional investments can yield in reality. * The dividend yield is for S&P500 non-zero dividend yields (source).

Meanwhile, traditional, balanced investment portfolios can work great.

But as I talk about here you really need to be able to dollar cost average into the market on a consistent basis over time and off the back of a fairly large salary in order to enjoy anything approaching appetizing returns.

Plus you need a 30-40 year time horizon to really reap the benefits.

So the question becomes…

What the heck can you invest in if you want the potential for much higher and attractive returns over the next say 5-10 years?

Well, before I show you my #1 favorite approach, let me tell you what I absolutely hate or otherwise think is a ’no’.

3 types of investments you should probably avoid

1) Avoid anything with a ‘get rich quick’ vibe

These ‘opportunities’ get a big HELLS NO from me. Actually, they get my blood boiling!

And gee whiz there are a lot of these investment schemes bubbling around ye olde interwebs.

Think anything from the downright crazy – e.g. P2P lending to 3rd world entrepreneurs at 10% monthly interest rates (say hello to ridiculous default rates and goodbye to your principal) – to the utter BS ideas like buying Google Adword enabled niche sites that supposedly generate 100%+ ROI year on year, but actually end up being total wealth destroyers as their underlying revenue model and associated income streams never actually eventuate or otherwise fail to sustain themselves over time!

That was a mouthful.

Photo: this is a real life example of a get rich quick idea! Hence the blacked out info. Needless to say, avoid.

And don’t even get me started on the rest of the crazy ideas you see popping up on clickbait articles and flashy banner ads like ‘Make thousands a day trading forex using our proprietary system’.

Ay carumbaaaaa!

My rule is pretty simple…

…if it sounds anything like the type of investment opportunity a young Jordan Belfort might shout down the phone to an old lady in Wolf of Wall Street, run for the freakin hills!!

Or to quote Charlie Munger (Warren Buffett’s famed business partner)…

“When any guy offers you a chance to earn lots of money without risk, don’t listen to the rest of his sentence. Follow this, and you’ll save yourself a lot of misery.”

In other words, the old adage applies…

…if it sounds too good to be true then it probably is.

What else should you avoid?

2) Consider avoiding any direct investments in technology

Although technology/software will to quote Marc Andreessen, “eat the world”, you should probably forget about investing directly in high tech ideas if you don’t understand them fully or have a high risk tolerance.

Because not only is it tough to predict which industries are ripe and ready to become ‘the next big thing’, it is even harder to pick which individual companies within an industry will be the winners and which will be the losers.

Photo: In 1999 just before the tech bubble burst, Buffett talked about how difficult it is to pick winners v losers in tech. In this case he was talking about aircraft makers: “So I went back to check out aircraft manufacturers and found that in the 1919-39 period, there were about 300 companies, only a handful still breathing today.” Read Blodget’s full article here.

If you can’t pick the winners and losers, then you can of course always gain some exposure to exponential technologies by investing in diversified tech ETFs (exchange traded funds).

ETFs are exchange traded funds. Basically they combine a bunch of different companies into one fund you can invest in.

And so these can be a great way for taking the guessing out of the game and simply investing in the trend.

I personally invest in the following tech ETFs using the dollar cost averaging technique:

- XT – a broad basket of companies making or using exponential technologies, especially in health, eg 3D printing, AI etc

- ROBO – focused basket of companies making or using robotics and automation

- FDN – diverse basket of Internet companies, eg Amazon, Netflix etc

- HACK & CIBR – like FDN but focused on cyber security companies specifically

Dollar cost averaging – ie putting a bit of money in every month or so – is a great way to smooth out the fluctuations in tech valuations over time.

So just to sum up here – when it comes to investing in tech, you should probably avoid any direct tech investments unless you fully understand them and know how to separate the winners from the losers.

And if you want to get some exposure to tech without trying to pick individual companies, then tech-focused ETFs – where you basically get exposure to dozens of different companies – might be the easiest approach to go for.

It goes without saying, this is not investment advice!

Do your own due diligence and speak to an investment advisor.

(Lawyer hat off).

3) Ignore investing in anything that is hard or impossible to get access to

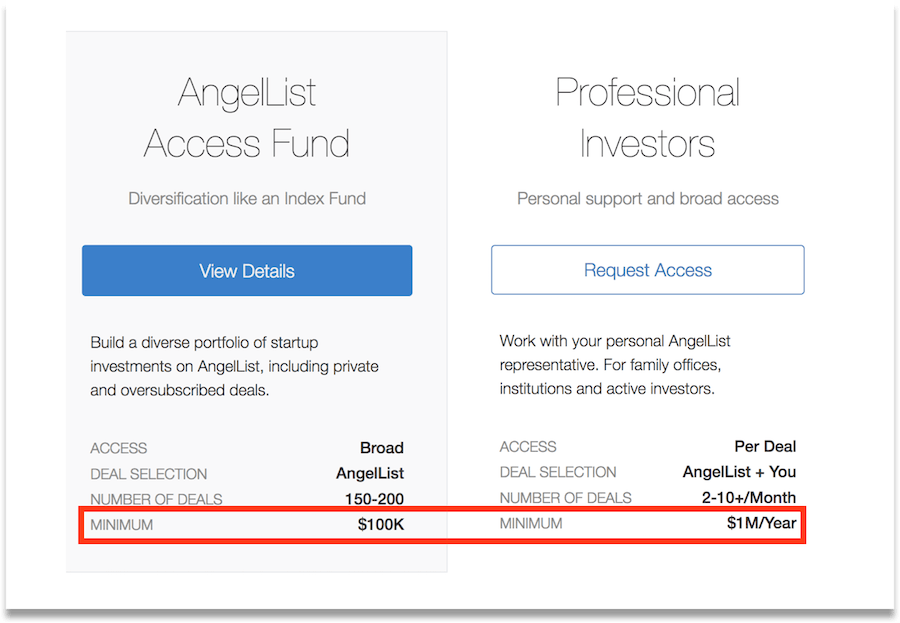

Finally, there are a variety of high return opportunities that you’ll most likely have to avoid simply because they require a lot of capital and/or access to exclusive networks.

I’m talking about all kinds of advanced investment strategies here, from investing in private businesses, aka private equity, to financing early stage startups with high yield convertible notes or straight up seed capital.

That said, there is a growing trend in ICOs (initial coin offerings) that are allowing normal investors to get in on the ground floor of early stage startups and for small amounts (eg $5,000).

All you need is a cryptocurrency (normally bitcoin) to buy in and well let’s be straight up here…you also need a helluva lot of due diligence skill to know whether the startup is a legitimate entity or an outright scam.

It should be very clear that this type of investing is not for beginners and carries high risk (see Tim Ferriss’ quote below).

In fact, I dare suggest the only time you should even consider jumping into an ICO is when you know the people behind it very very well and you deeply believe in the value of the business they are bringing to market.

Photo: Investing in Angel List’s funds requires serious capital and as Tim Ferriss says “…startup investing is very risky, so again: don’t invest anything you aren’t prepared to write off 100%.”

Okay, so now you know what to probably avoid, the question becomes…

…what is my absolute favorite investment approach for normal investors looking for potentially high returns over the next 5-10 years?

Here we go.

My #1 investing approach for potentially high returns

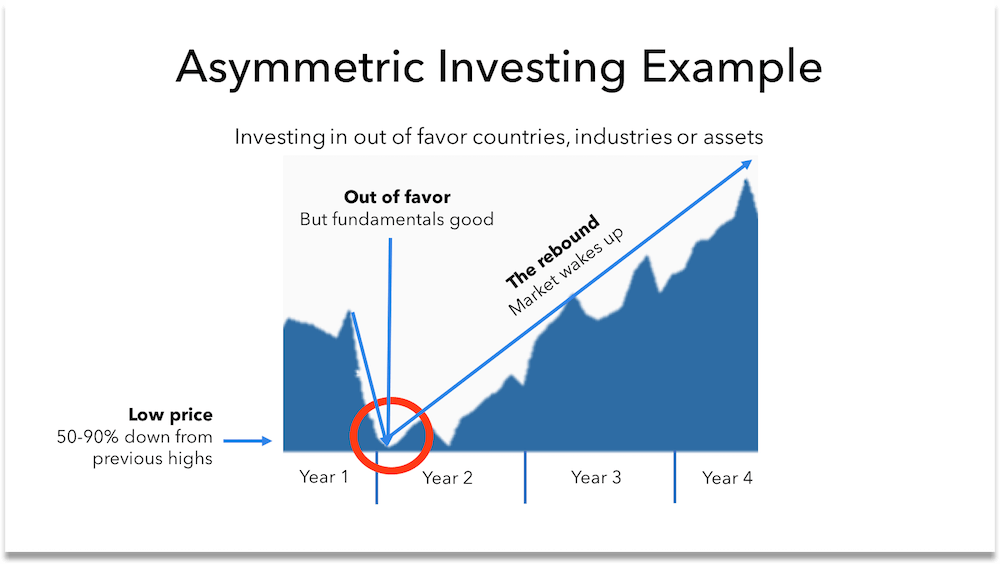

The strategy I use (and absolutely love) is investing in countries, industries and asset classes around the world that are currently extremely out of favor and priced extremely low, but whose fundamentals suggest an imminent rebound.

In other words, I’m looking for situations where the market has severely mispriced an asset and there is potential for huge 5-10x gains over the next 3-5 years as it rebounds.

The technical term for this investing approach is “asymmetric investing”.

And it is the approach favored by some of the world’s greatest investors and hedge funds.

Now, it sounds complex I know.

And well, it is.

But don’t worry if you feel this is a little above your pay grade – like I did when I first heard about it.

Because I’m going to break it down for you in plain English and give you a glimpse at something that few retail investors ever learn about, let alone understand and get to participate in.

Best of all, I’ll show you exactly how we can leverage the best brains in the investing world to easily identify these asymmetric investment opportunities and invest.

This is going to be exciting!

So what does this kind of investing actually look like?

And when I say we’re investing in countries, industries or asset classes that are ‘out of favor’, what do I mean?

Well, at any given time there are countries, industries and asset classes that will be priced 50-90% lower than their previous highs.

Meaning they are priced so low that the cost of entry (what you invest) relative to what you could potentially earn back (what you sell at), is asymmetric – or ‘out of whack’ if you prefer.

Photo: this is a real life example of an asymmetric investment, which I’ll reveal below. As you can see the asset falls out of favor with the market and drops in price. But with sound long-term fundamentals it is now mispriced and a very attractive opportunity for asymmetric investors.

Now I know what you’re thinking.

“Well, there’s a reason they’re priced so low”.

However, the market isn’t exactly rational in the short term, which is something I’ll talk about more below.

And identifying when the market is valuing certain countries, industries or asset classes irrationally (i.e. too low relative to their fundamental value) is THE investing approach Charlie Munger (Warren Buffet’s famed business partner) loves most, as he says:

“You’re looking for a mispriced gamble. That’s what investing is. And you have to know enough to know whether the gamble is mispriced.”

The main point here, is that if we can identify assets trading at extremely low prices but whose fundamentals are nowhere near as bad as the market thinks, it’s possible that we can invest pennies and potentially earn back dollars.

This mismatch of what you invest and what you can potentially get back is what asymmetry can look like! In fact it is the very definition of it.

But, and this is a big but which I can’t deny…

…these opportunities are not for the faint of heart.

In fact, I have no doubt that if you rang up a broker to place a trade in an asymmetric opportunity (e.g. an asset class down 70% from previous highs) they’d probably think you’re nuts and suggest checking in for an extended stay at the local asylum!

But forget about brokers.

Instead, let’s see what the legends of the investing world think about this approach.

What the world’s greatest investors think about this strategy

As one of the world’s greatest asymmetric investors Warren Buffett says…

“Be fearful when others are greedy and greedy when others are fearful.”

Or better yet, as Sir John Templeton, who Money Magazine declared “arguably the greatest global stock picker of the century”, said…

“Invest at the point of maximum pessimism.”

What these 2 legendary investors meant was simple…

…if you want to earn potentially incredible returns you need to buy when the price is low (and the fundamentals are better than the market thinks).

And that is only possible when investments are oversold and out of favor. Meaning when everyone else is NOT buying, or better yet, think it is nothing short of nuts to be buying!

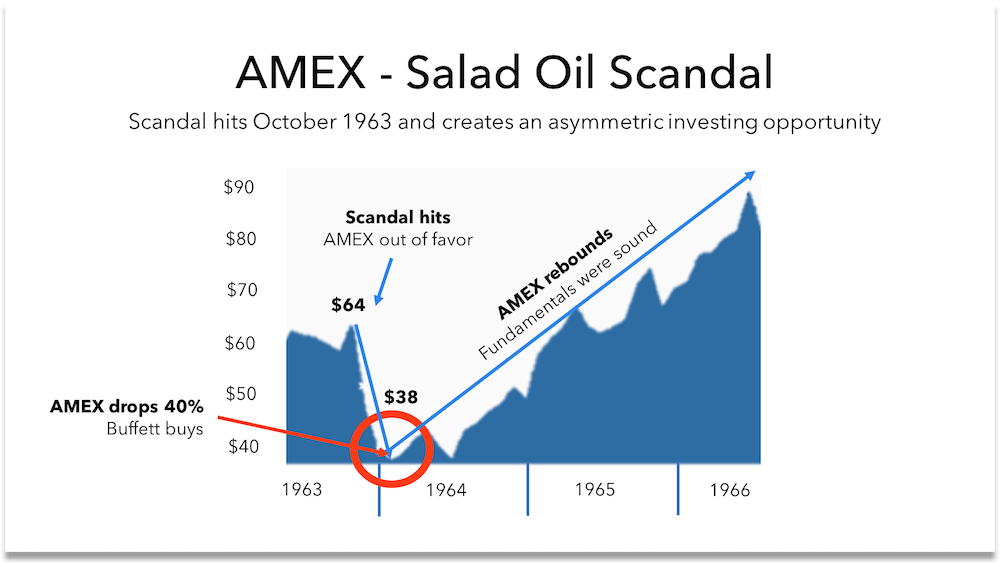

Photo: this is the real life asymmetric trade we first looked at above. AMEX was embroiled in a scandal in late 1963. It fell significantly out of favor with the market. No one was buying. But Buffett knew better and invested in this asymmetric opportunity.

In other words, if you want the potential for high returns you can’t follow the herd.

It is only by being contrarian and investing at extreme lows that one can ever expect to go on to enjoy potential 5-10x returns.

Ironically this investment approach might favor normal investors most

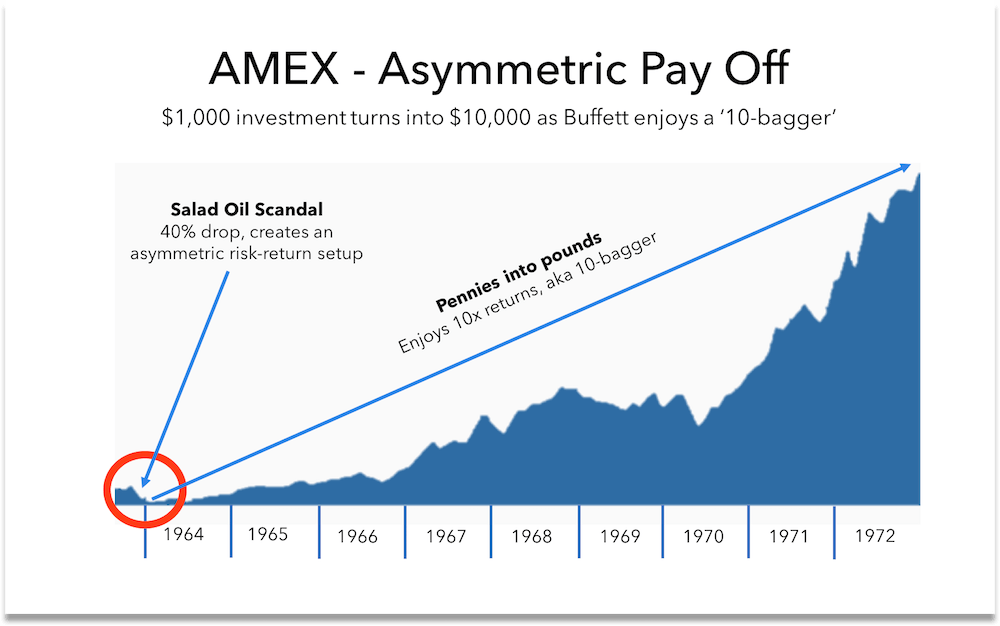

Although the world’s greatest investors love this approach, funnily enough it has the most potential to benefit normal retail investors.

You see, if you don’t have a large capital base for investing (e.g. if you have less than $100,000), then this contrarian ‘buy low’ investing approach becomes even more attractive because all of a sudden a little has the potential to go a long way.

Photo: the payoff on just $1,000 of capital was huge with the AMEX asymmetric investment. Showing just how well these opportunities can work even if your capital base is not large.

And this point is oh so important.

Because as we looked at above, if you have a low capital base, traditional investment opportunities are going to offer returns that will barely allow you to afford an annual family pass to Disney Land!

Perhaps best of all, when you invest in these asymmetric opportunities you don’t need the investments to rebound back to their all time highs to make money.

Rather, you just need things to ‘get a little bit better’.

That’s it!

i.e. we don’t need miracles to happen to enjoy high returns. Instead, we just need the negative news dogging the industry or asset class to simply go from terrible to ‘not as bad’.

Okay, this all sounds wonderful, but what’s the catch?!

An oh so important question to ask, especially if we think back to Charlie’s quote above about people promising high returns.

Well, the catch is simple…

…these opportunities are notoriously hard to spot.

If you’ve seen the movie The Big Short you’ll know what I’m talking about.

In the movie, which is based on a true story, you’ll recall that whilst a handful of savvy investors spotted the approaching 2007 subprime mortgage crisis (and the asymmetric investing opportunity it presented, i.e. shorting the housing market by buying extremely cheap credit default swaps), the rest of the entire financial industry did not.

All those supposedly smart Wall Street brains missed it completely!

Photo: from the article pictured above; “Zuckerman presented a paradox that “it should have been the experts who saw this coming — the Wall Street types and insiders,” but it turned out that they missed the “coup of the century,” and instead, a handful of “outliers” got it right.”

Proving just how difficult it is to spot these asymmetric investment opportunities.

And hey, it’s not surprising they missed it.

After all, this has been happening since markets began.

For example, as we looked at above, many years back in the 1960s Buffett pulled off a fantastic asymmetric investment.

American Express was in turmoil. It was reeling from the ‘Salad Oil Scandal’. And its stock price had dropped 50%!

The market hated American Express. No one was buying. And anyone who was, was nuts!

Or so the market thought.

But Buffett knew that AMEX would rebound soon, because its fundamentals were still sound.

And with Templeton’s maxim “Invest at the point of maximum pessimism” in mind, what did he do?

He used 40% of his capital – nearly half of his money! – to buy 5% of American Express.

And well we all know from the graph above what happened from there, as this asymmetric investment went on to produce astronomical returns for Berkshire. And has continued to ever since.

So as you can see, whilst most professional investors can spot an extremely low priced investment, very few can work out whether the fundamentals are not as bad as everyone thinks and thus whether it will recover.

i.e. being smart enough to actually identify truly mispriced assets – where there is asymmetry in risk to return – is the first and biggest catch with this investment approach.

There is another catch when it comes to asymmetric investing

You see, not only is it hard to spot these opportunities, but it also requires serious courage, or to quote Alec Baldwin’s character in Glengarry Glen Ross, it requires ‘brass balls’!

Or to put it in more eloquent terms, I refer to Ray Dalio, head of the world’s largest hedge fund, Bridgewater Associates:

“In order to make money in the market you have to be an independent thinker.”

You see, if we look back again at the movie The Big Short, remembering that this is based on a true story, you’ll recall how much pressure Michael Burry (played by Christian Bale) was under for not only buying the shorts, but then holding onto them as the market continued to go up (against his position).

People literally hated him.

They thought he was nuts!

Proving just how lonely the world can be for asymmetric contrarian investors.

Photo: Dr Michael Burry (left) played by Christian Bale (right) in The Big Short. The cajones he had is what all asymmetric investors should aspire to, as New York magazine writes about in detail here.

And unfortunately, most people simply don’t have the emotional intelligence of a Michael Burry to not only invest in an opportunity so out of favor, but also the wherewithal to hold it long enough to see the asymmetric returns come to life.

But we can take great comfort in Sir John Templeton’s experience that:

“If you want to have a better performance than the crowd, you must do things differently from the crowd.”

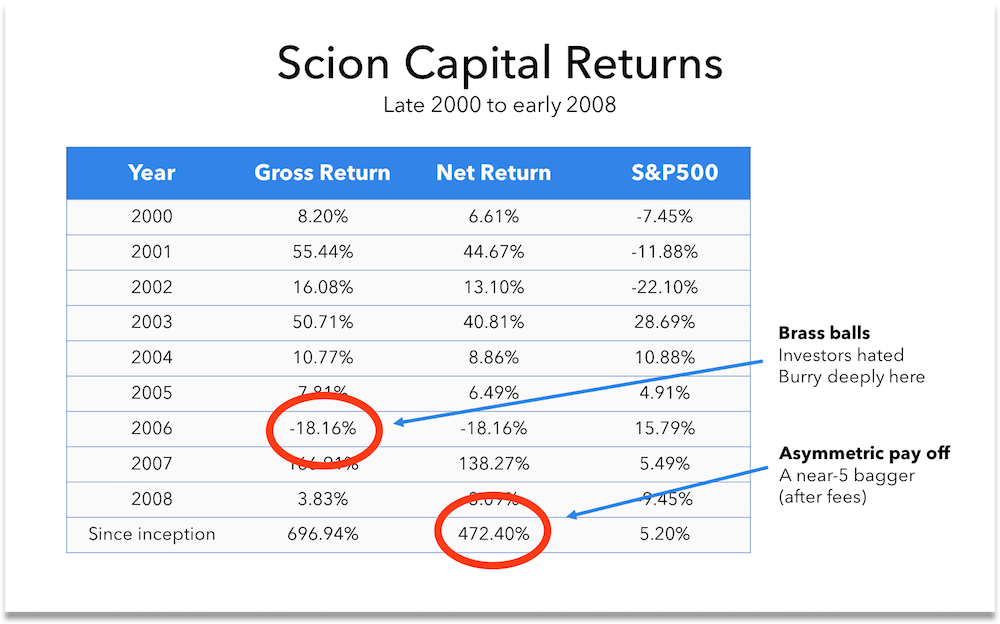

And of course we can also take comfort in Michael Burry’s returns as his fund, Scion Capital, enjoyed a 5-bagger (i.e. 500% return) investing in the asymmetric housing market opportunity:

Photo: Scion Capital’s returns were huge, because Burry found an asymmetric investing opportunity and had the wherewithal to not only invest in it, but hold it, even when his investors thought he was nuts, and literally hated him.

The final catch with this investing approach

Well, even if you somehow spot the opportunity (kudos to you), and have the emotional intelligence to get involved and stay involved, it can be extremely hard to know exactly how to invest in the opportunity in the first place.

i.e. it is very difficult to work out which specific stocks to buy or what options to take up.

And indeed, if you choose the wrong one, all your hard work in spotting the opportunity can come to nothing.

Or worse yet, you can lose money!

So as you can see asymmetric investing is not easy for multiple reasons. And although you can potentially earn huge returns when you get it right, there are some serious obstacles in your way.

So how do I personally overcome these huge obstacles & invest in asymmetric opportunities?

Well, that’s a good question.

After all, I am busy running several online businesses with large teams and even more ambitious goals to boot.

And despite studying and actively investing for years and years, I am far from becoming an investing legend like my heroes Warren and Charlie.

Meaning I don’t have a hope in hell of either finding the time to scour the world for these opportunities or the ability and skill to work out which ones to invest in.

So what’s my secret?

Simple…

I look for the smartest investors in the world & invest alongside them

Anyone that knows me, knows I’ve obsessively spent years and years searching out the world’s sharpest investors.

The ones that not only understand how to spot these asymmetric opportunities opening up, but also have the extensive networks of savvy contacts to help them further separate the potential winners from the losers.

After years of painstaking research and having read 1000s of reports from over 200 world class investors, I finally narrowed down my shortlist to a top 10 based on track records and of course, their reasoning behind every investment decision they’ve made.

But unfortunately I ran into a problem with my top 10.

You see, it turns out almost everyone on this list was a world class investor I couldn’t invest alongside, simply because of the way they invested.

For example, let’s take Warren Buffett and Charlie Munger.

I would love to invest alongside them.

But the problem is their greatest investments come from buying entire companies (eg his recent $37.2 bn acquisition of Precision Castparts) or investing at special terms (eg Goldman Sachs gave Buffett extremely favorable investing terms during the global financial crisis). Both leaving me in the cold.

Photo: you can read more about how difficult it is to match Buffett’s strategy over at Forbes.

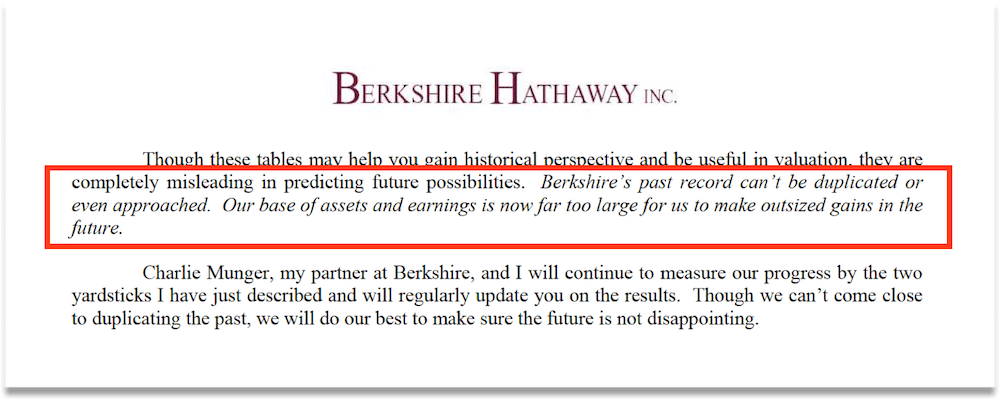

Furthermore, expecting high returns by investing in their holding company, Berkshire Hathaway, is nothing short of fanciful because of the insanely large capital base they are weighed down by these days.

Something Buffett himself has warned Berkshire investors about again and again as he says: “Our base of assets and earnings is now far too large for us to make outsized gains in the future.”

Photo: The extract from Buffett’s letter to shareholders, showing us why we need to seek another investor to follow if we hope to make outsized gains.

Thankfully though there was one investor on my shortlist who was executing an asymmetric investing strategy and smart trades that I could actually match!

After years of painstaking research I finally found a world class investor I could invest alongside

This is someone who’s approach – and most of all whose incredibly thoughtful insights and rational reasoning – is so in alignment with mine, it is extraordinary.

This investor I admire so much is of course Chris MacIntosh of Capitalist Exploits fame.

He is a wickedly smart former investment banker and VC (venture capitalist) with an enviable track record, and he currently runs the high performing hedge fund, Asymmetric Opportunities Fund.

With decades of experience investing across the globe and “turning pennies into pounds”, it is no wonder this is the asymmetric investor everyone loves to talk to – with Chris being featured most recently in Wall Street Journal’s Market Watch, Business Insider and the new gold standard in financial media, Real Vision.

In addition to an impressive track record, Chris’s fresh insights and ability to spot the new opportunities opening up that others can’t, impresses me to no end.

Unfortunately it is very difficult to gain access to someone like Chris

You see, people like Chris typically reserve their specific investment and trade ideas exclusively for their own hedge funds.

And Chris has in fact been doing exactly this with his own Asymmetric Opportunities Fund.

Which means whilst I’ve spent years poring over Chris’s general research and reports, I’ve previously never been able to access his specific investment ideas.

So although I’ve followed his Twitter stream like an investment groupie, religiously read his financial musings week after week, and desperately tried to glean ideas from his interviews and podcasts, I’ve essentially been locked out in the cold when it comes to his specific investing ideas.

In fact, until recently unless you had a couple million to invest into his hedge fund there was no chance of knowing his ideas.

Talk about hard to access!

But this all changed with the launch of Chris’s investing newsletter

Late last year Chris finally opened up access to his best investment ideas with the launch of his investing newsletter, INSIDER.

And gee was I excited!

Finally I could invest directly in the fascinating asymmetric opportunities he and his team were piling into through their hedge fund.

In Chris’s own words the launch of the newsletter means…

“The opportunities shared [in INSIDER] will allow you to get in on the same investments being taken by myself in my hedge fund and those of my rolodex of friends, some of the world’s elite investors. Usually, opportunities like these are reserved for industry insiders. And it’s very unlikely that your broker has even heard of many of them, and he’s almost certainly got little idea why you’d be doing them.”

As you can imagine, I of course subscribed the minute the newsletter became available.

Now, as someone who has spent over $40,000 on investment research in the past (think newsletters, databases, masterminds etc), I can tell you this has been my greatest investment by far.

And that’s simply because the returns thus far have been phenomenal.

My results so far following Chris’s asymmetric investment ideas

Well, I’m up approx 42% in just 5 months, giving me an annualized return just over 100%.

Unsurprisingly, this has meant I’ve paid back the cost of my newsletter subscription dozens and dozens of times over. Which is extraordinary in such a short period of time.

Before I go on, let me put my lawyer hat on and remind us all that past performance is no guarantee of future results. Never has been, never will be.

Apart from the returns I’ve experienced, I am also a big fan of Chris’s newsletter because he not only shares very specific and easy to follow investment ideas, but he also tells you exactly how to execute each trade.

And so armed with Chris’s advice, I know exactly which investments to buy, plus how much to buy of each based on my existing capital.

Which is a really important point!

Because if you’re anything like me, then you don’t have the decades of investing experience, let alone the time, to work it all out by yourself.

Importantly, all his ideas are asymmetric.

Meaning the buy in prices are extremely low and the potential for 2-10x returns is there.

If you have a low capital base, this can make all the difference.

And as Chris says himself:

“I’ve found that the money made from just one or two massive asymmetric investments is enough money to buy a new house, look after a loved one in need of care, or put a kid through college.”

This might sound ridiculous, but I’m actually seeing this come to fruition right now with one of the investments he recommended.

Hint: it is a highly disruptive and exciting asset class and it still has a lot of potential room to grow.

The markets are changing dramatically & old investment approaches are unlikely to keep working

I’m so sick and tired of all the terrible investment advice out there.

It literally pains me when readers write in with crazy ideas like “This time it’s different” or “Market cycles don’t matter any more”. Or some other utter drivel they’ve heard from finance ‘experts’ on TV. (You know the ones)

Everyday investors seem hellbent on continuing to invest like they’ve always done. And they think everything is going to be fine.

It most likely won’t.

Right now we are entering a period when I can see a lot of people potentially losing a lot of money, or best case scenario, seeing very flat returns (hello insanely overvalued markets!).

And I don’t want to see that happen to readers like yourself.

I refer back to Sir John Templeton when he said…

“Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria.”

And have you ever seen a more euphoric stock market investing environment?!

I dare say we’re starting to make the 2000 Internet bubble days look like a freaking funeral procession by comparison to today’s irrationally exuberant financial fiesta!

And whilst the general market is likely in for some serious pain in the years ahead, a very small collection of investors – the savvy ones (like Chris, Buffett, Burry etc) – are going to potentially make a lot of money thanks to the asymmetric market opportunities simultaneously opening up.

As Chris says “the repricing of assets promises to be truly breathtaking”.

Making it (very ironically) an extraordinary time to be investing!

And I can’t help but think of Bob Dylan when he ‘sang’:

“You better start swimmin’ or you’ll sink like a stone…for the times they are a-changin’”.

So if you have some capital to invest, appreciate how the markets are changing quickly and want to take advantage of the potentially huge opportunities coming up then I strongly recommend you checkout Chris’s newsletter, INSIDER, here.

Proudly I recommend very few resources on this site

In fact, I barely promote or affiliate any products on this site. And most of the resources I do recommend are 100% free.

And that’s because I never built this site to make money. I already make more than enough from my online businesses, e.g. my two health ecommerce companies.

Instead, I built this site to summarize all my knowledge and in doing so, help me think through my own businesses and investments better.

For example, this very article helped me clarify/solidify my decision to prioritize asymmetric investing opportunities (like the ones Chris recommends) over investing in early stage exponential technology.

A very very very big decision for me! And one that can easily be worth millions to me over my investing life.

Also, I don’t promote many resources on this site because I take Charlie Munger’s words to heart:

“Remember that reputation and integrity are your most valuable assets – and can be lost in a heartbeat.”

So please understand that my recommendation of Chris’s newsletter, INSIDER, is very special.

And I happily stake this site’s reputation on it.

And guess what, so does Chris.

Because unlike most financial ‘gurus’ out there (think CNBC talking bobble heads that look like they’re about to pop a neck vein when the market goes down 0.2%), Chris actually pours millions of his own money into the investing ideas he recommends.

He has skin in the game!

This is very very unusual. And makes him eminently more trustworthy than all other investment ‘gurus’ out there.

In fact, if you look at the disclaimer at the bottom of most typical investment articles it specifically says the author does NOT have a stake in the investment recommended!

Just another reason I trust and invest alongside Chris and the Capitalist Exploits team.

Of course, you should do your own due diligence, consult a financial advisor and understand that there are absolutely no guarantees of results whatsoever.

Also, although I am an affiliate partner now, you should know two very important things.

Firstly, I pay for my INSIDER newsletter subscription personally. Meaning no freebies in exchange for review or any of that utter BS, which I see everywhere online.

Since I earned back the cost of my subscription with just my first trade, I have no problem paying for it personally either.

Also, when I signed up Chris didn’t actually have an affiliate program. Therefore promoting it wasn’t even a thought I entertained.

Secondly, the money I earn from this partnership, I will be investing back into more of Chris’s investment ideas – alongside large amounts of personal wealth as well.

Remember how I talked about the importance of having skin in the game?

Well there you go.

That’s how much I believe in his approach and newsletter. And that’s why I’m sharing it with you.

Before you sign up, I want to share a quick warning

Before you consider signing up for Chris’s INSIDER newsletter, I should say who it isn’t for.

If you are politically sensitive, you should perhaps give it a miss.

Chris does not care about your politics or mine, he only cares about whether there is a good investment opportunity to be found. So if you are sensitive or overly politically correct, you might get offended (and potentially miss out on some fantastic trades).

If you don’t have $5,000 or more to invest, then perhaps wait.

You might be better starting up a passive income business first, which can then supply you with capital to invest. Checkout my other ideas on this site to help with that.

If you don’t have the patience to hold these out-of-favor investments – like Michael Burry and the other guys did in The Big Short – then you should probably avoid it too.

Emotional intelligence is essential as an asymmetric investor.

If you are simply not sure whether this is for you, then I recommend you read the information page here.

If it sounds at all interesting, sign up and test drive it for 30 days.

Because here’s the great thing about Chris…

…he offers a 30 day grace period after you sign up.

Meaning you can gain access to all the trades and the new ones released during the next month, risk free.

And then if at the end of the 30 days you feel like it’s not for you, simply email the team for a refund. Simple.

So if you are eager to discover the asymmetric investment opportunities the world’s sharpest investors are piling into – and which I personally am pouring a significant part of my wealth into – then you owe it to yourself to check out INSIDER.

Because this is my absolute #1 investment strategy and I believe it will help me generate potentially legendary profits in the coming months and years, whilst the rest of the market likely goes down or at best, stays very flat.

Click here to sign up for Capitalist Exploits INSIDER today >

“To buy when others are despondently selling and sell when others are greedily buying requires the greatest fortitude and pays the greatest reward.” — Sir John Templeton

By Richard

By Richard